Cryptocurrency & Tax in Australia

A quick reference guide to crypto tax in Australia to assist you during tax time.

Crypto Tax in Australia: Overview

In this article we’ll cover a range of cryptocurrency tax topics that may assist you during tax time. Whilst this article is based on the most recent information available from the ATO, the space is always evolving, and information provided may be subject to change. We do not provide tax or financial advice and the information provided is general in nature. We recommend that you speak to a registered tax professional for individual advice and check the Australian Tax Office and Business.gov websites for the latest information. Tax information from the ATO about cryptocurrency in Australia can be found here.

Contents

- How is Cryptocurrency Classified by the ATO?

- Are you an Investor or a Trader?

- Capital Gains Tax (CGT)

- 12-Month CGT Discount

- Capital Losses

- Capital Gains Exceptions

- Crypto to Crypto Trading

- When does income tax apply, and how do I calculate it?

- How much will I be taxed on cryptocurrency income?

- Where can I find a record of all my CoinSpot transactions?

- What tools can I use to assist with my tax return?

- Need more help?

How is Cryptocurrency Classified by the ATO?

The profit made from cryptocurrency is determined in AUD amounts when you exchange crypto for AUD, other cryptocurrencies or goods & services.

Depending on the situation you can get taxed in two different ways:

- Personal Investment

- Trader (Business Income)

Are you an Investor or a Trader?

Investor:

If you are someone who is primarily buying and selling cryptocurrency for personal investment then you will likely fall into this category. Examples of activities that you may participate in are:

- Buying coins to hold long term

- Participating in staking, forks and airdrops

- Casually trading cryptocurrency

Trader:

This category would apply to someone who’s primary cryptocurrency activities are for business income. Therefore, your profits or losses may be subject to the relevant type of income tax, rather than capital gains tax.

Examples of activities that you may participate in are:

- Professional crypto trading

- Commercial cryptocurrency mining

- Operation of cryptocurrency-related businesses

Capital Gains Tax (CGT)

Capital Gains: The ATO does not view cryptocurrency as money, they classify it as an asset, similar to shares or property. This means that every time you sell or trade your crypto, it is classed as a capital gains event.

A capital gains event only occurs when you do something with your crypto. If you only buy and hold, then you don’t need to pay tax on your crypto, even if the value of your purchased coins has increased.

If you make profit on a transaction, then you’ll need to pay tax on your capital gain.

Here is an example;

- You buy bitcoin at $10,000.

- Three months later sell it for $15,000.

- You have made a capital gain of $5,000.

12-Month CGT Discount

There is a discount for those who hold an asset long term. If you hold an asset for over 12 months, you will only pay tax on 50% of your capital gain. Going back to the above example;

- You buy bitcoin at $10,000

- Two years later sell it for $15,000

- You have made a capital gain of $5,000.

Capital Losses

If the value of your crypto is worth less at the time it is sold, then when you bought it, you have made a capital loss. Capital losses can be used to offset capital gains either in the same financial year or in subsequent financial years.

For example;

- You make a capital gain of $5,000 on your first transaction

- You buy another Bitcoin for $10,000

- Then sell it for $8,000 two months later

- That’s a capital loss of $2,000 on the second transaction

Capital Gains Exceptions

There are certain exemptions that may apply depending on how you use your crypto;

Personal Use:

If you use crypto to purchase goods or services, then it would be considered a personal use asset and is not subject to CGT. More info can be found here.

Donations:

If you donate your cryptocurrency to a registered charity, then it’s not considered a capital gains event and you can claim the amount on your tax return.

Lost/Stolen Coins:

If your coins have been lost or stolen (for example, you have lost your cold storage wallet), you may be able to claim the value of the coins on the day they were lost or stolen as a capital loss.

Crypto to Crypto Trading

It is possible for users to only complete crypto to crypto trades in a tax year without ever using any fiat currency. Even though trading from crypto to crypto means that any gains you made haven’t actually involved AUD, CGT still applies.

When you trade one cryptocurrency for another, you’re effectively receiving an asset rather than money in return for the first crypto. Therefore, you’ll need to keep records of all your trades so you can calculate any capital gains or losses for your tax return.

When does income tax apply, and how do I calculate it?

If you’re receiving cryptocurrency as payment for goods or services, or by mining it, this will count as ordinary income that is taxable.

The way the value is determined is with the market value of the cryptocurrency on the day that you received it.

This figure is used to determine the income amount that is relevant to you. Deductions are relevant if you’re declaring cryptocurrency as ordinary income, so it’s important to understand how they can impact your specific situation. For example, business expenses that are incurred by acquiring cryptocurrency itself, can be deducted from your annual tax return in the same way, as if they were paid for with AUD.

For example;

John is a full time cryptocurrency trader and he purchases 10 ETH for a total of $10,000.

On the same day, John sells 8 ETH for $12,000.

John can claim a deduction of $10,000 for the initial purchase of 10 ETH, then declare the $12,000 he made selling 8 ETH as income.

John must also apply the trading stock rules to determine if there is any income or deduction due to the change in value of his closing assets.

How much will I be taxed on cryptocurrency income?

Please refer to the table below from the ATO to see your relevant tax bracket and how it applies to your circumstances.

| Taxable Income | Tax on Level of Income |

|---|---|

| $0 - $18,200 | Nil |

| $18,200 - $45,000 | 19 cents for each $1 over $18,200 |

| $45,001 - $120,000 | $5,092 plus 32.5 cents for each $1 over $45,000 |

| $120,001 - $180,000 | $29,467 plus 37 cents for each $1 over $120,000 |

| $180,001 and over | $51,667 plus 45 cents for each $1 over $180,000 |

*The above rates do not include the Medicare levy of 2%.

Where can I find a record of all my CoinSpot transactions?

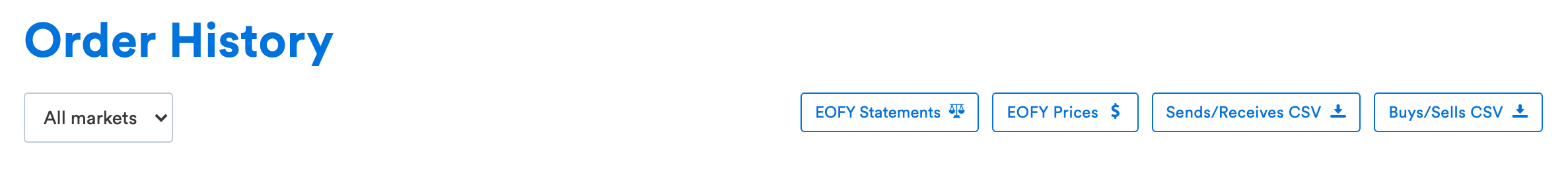

CoinSpot provides numerous free reports that will assist with your tax return. These can be found on the top right of the Order History page.

What tools can I use to assist with my tax return?

There are many tools on the web that can be used to assist in record keeping and generating reports for tax time. Some of these include cryptotaxcalculator.io, koinly.io, syla, cointracker.io, and cryptotrader.tax.

There are typically two ways you can import your transactions to these platforms, via an API or by downloading your .CSV files from CoinSpot and uploading them.

When using an API it is very important to provide READ ONLY access to a third party and NOT full access.

Need more help?

Please submit your request via Zendesk:

https://coinspot.zendesk.com/hc/en-us/requests/new

or start a conversation with us via Live Chat.

Join 3 million other users

and start earning!

CoinSpot

CoinSpot