How to Buy Bitcoin with Commonwealth Bank

5 minutes

5 minutes

5 minutes

5 minutes

Australian investors can buy Bitcoin and other cryptocurrencies through Commonwealth Bank by transferring AUD to approved local exchanges like CoinSpot. CommBank allows transfers to platforms that meet the strict AML/KYC standards set by the Australian Transaction Reports and Analysis Centre (AUSTRAC).

Below is a quick breakdown of how to invest in digital assets using your CBA account.

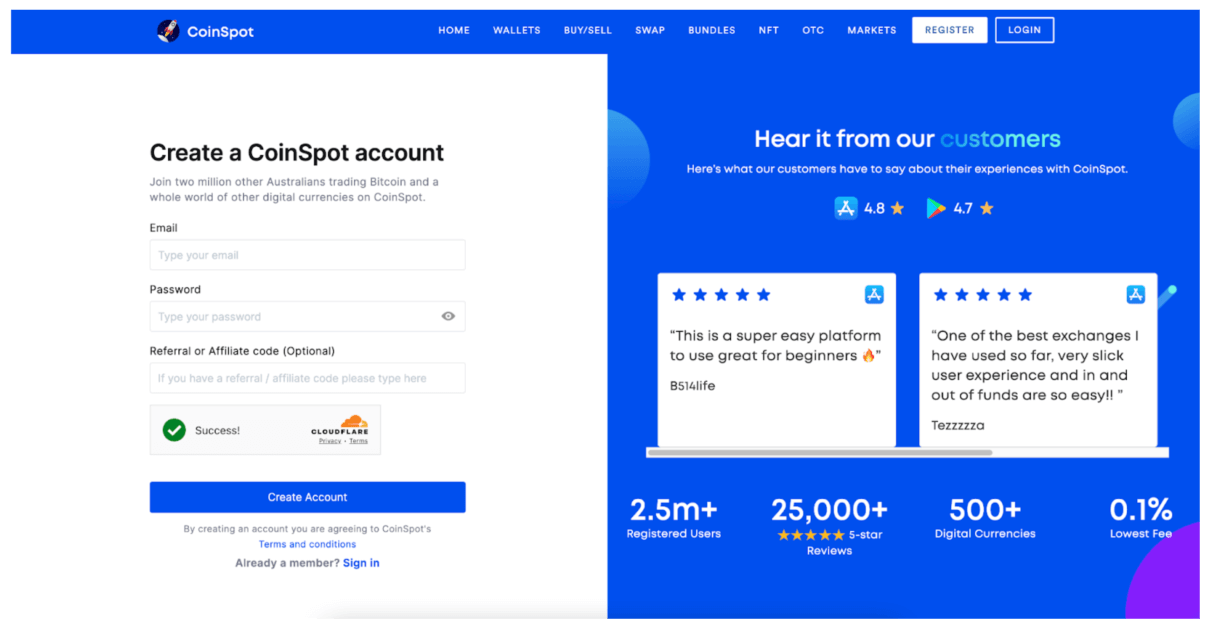

Create an account on CoinSpot and verify your identity. To do this, you will need to provide information to open your account, which includes:

This step is essential due to AUSTRAC’s strict anti-money laundering (AML) and counter-terrorism financing (CTF) rules. It's mandatory for anyone using an Australian bank to verify their identity in order to invest in cryptocurrency.

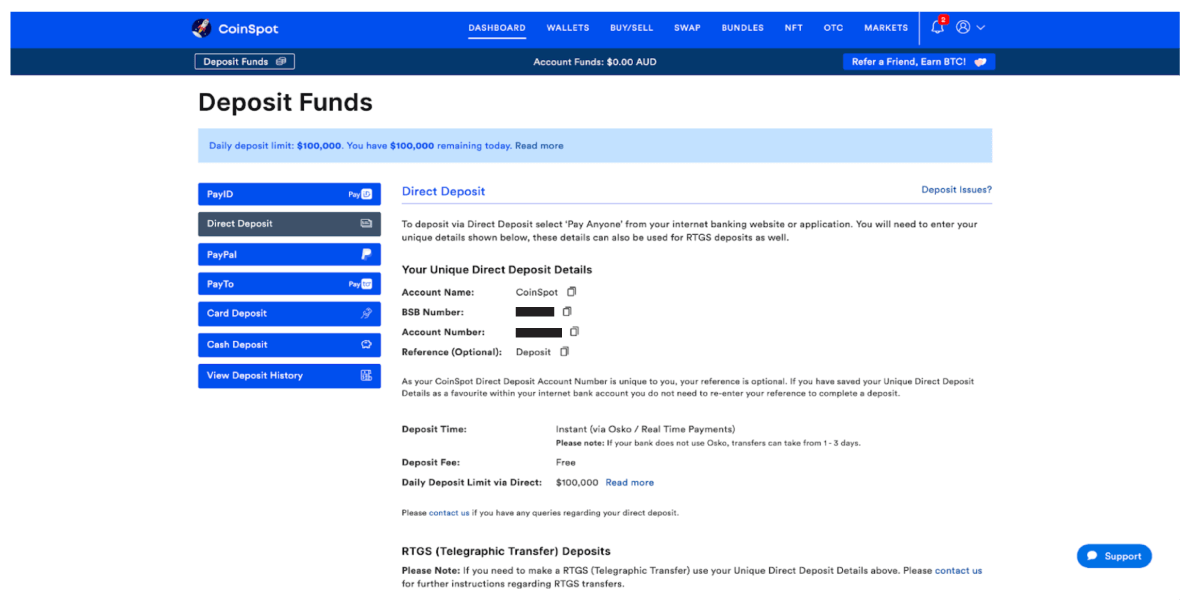

Once you have completed your account verification, head to the deposit funds page. You can transfer AUD from CommBank using PayID, direct deposit, or a card deposit. PayPal is another option for those who have linked their CBA card to the PayPal platform.

To do this, simply select a deposit method and follow the on-screen prompts to complete your transaction.

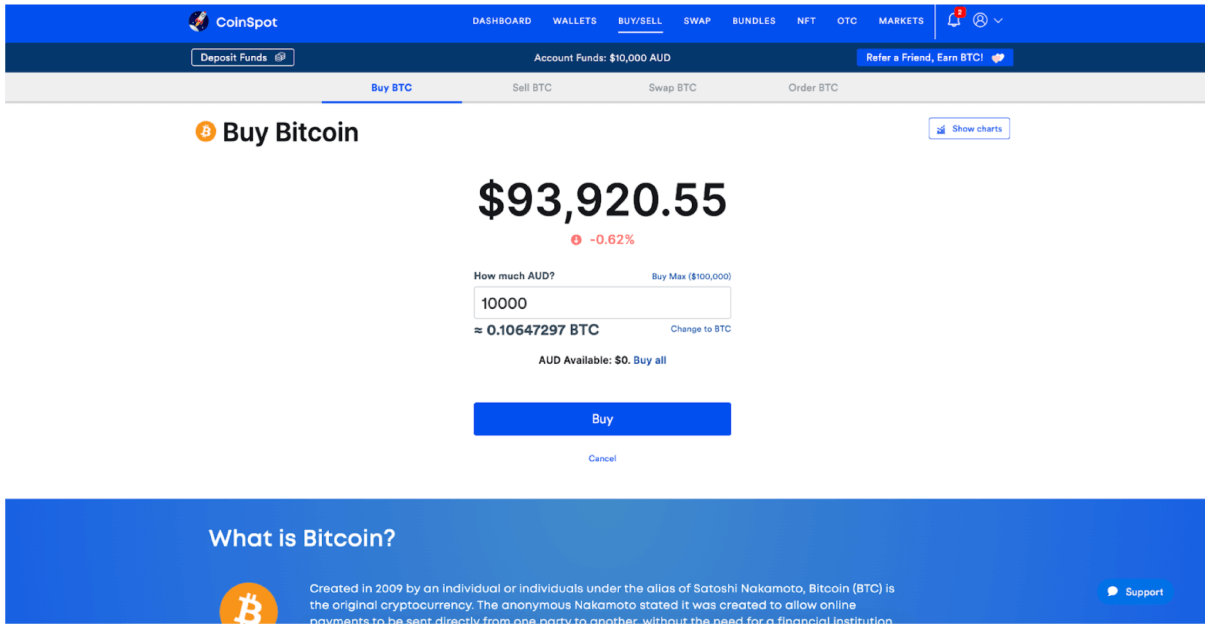

When your funds arrive in your account, navigate to the CoinSpot trading dashboard and find the cryptocurrency you want to buy.

After you select the coin (e.g. Bitcoin), input your desired investment amount and select “Buy” to execute your trade.

CommBank has rolled out new measures targeting cryptocurrency transactions to clamp down on fraud and scams. Here’s a quick breakdown of what’s changed and why it matters.

These measures might change, so it’s worth monitoring any updates to Commonwealth Bank’s cryptocurrency policy.

When topping up your crypto account using Commonwealth Bank, your best bet is PayID or Direct Deposits. They're instant and free, with a minimum deposit of just $1. Here are CoinSpot’s supported payment options:

For withdrawals, PayID and direct deposits are free, while PayPal withdrawals come with a 2% fee (capped at $1.25).

CommBank offers Aussie investors several ways to fund crypto exchanges, with PayID and direct deposits being the most affordable options. Deposits are capped at $10,000 per month, with a mandatory 24-hour hold to curb fraud. Withdrawals aren't restricted, so getting your funds out is easy.

Keep an eye on any policy updates to ensure your crypto investments stay compliant with CommBank and Australian financial regulations.