What Is Decentralised Finance (DeFi)?

5 minutes

5 minutes

5 minutes

5 minutes

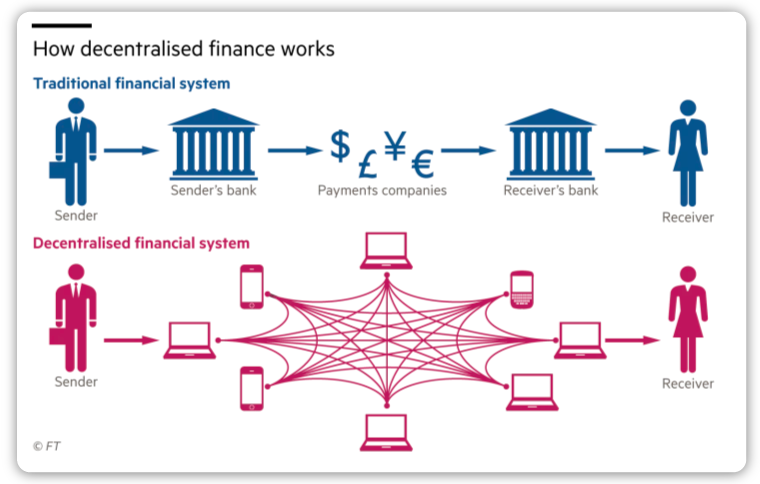

Decentralised finance, or DeFi, refers to a suite of crypto projects decentralising traditional financial services. Built on blockchains, DeFi allows users to participate in activities like lending, borrowing, and trading without relying on banks or other centralised entities. This system empowers individuals to directly manage their assets, providing enhanced transparency and accessibility.

DeFi encompasses a range of protocols, broadly divided into three main categories.

Platforms like Uniswap (UNI) allow users to trade cryptocurrencies without central authority, leveraging smart contracts to execute trades. These exchanges have evolved to offer users additional ways to earn through liquidity provision.

Projects like Aave (AAVE) enable users to lend or borrow cryptocurrencies in a decentralised and trustless manner. These protocols often operate on an over-collateralised basis, ensuring depositors' funds are secure even in volatile markets.

Projects like Lido (LDO) provide users with staking opportunities, allowing them to support blockchain network operations and be compensated through token rewards.

Traditional finance relies on institutions as intermediaries, which add fees and conditions to users' access to financial services. DeFi eliminates the need for these entities, using smart contracts and blockchain technology to facilitate financial transactions in a trustless manner. It puts control back into the hands of users, offering opportunities to interact with financial products on their terms.

DeFi addresses several fundamental shortcomings of the traditional financial system by introducing transparency, efficiency, and accessibility.

DeFi brings a new level of transparency to financial systems. Most reputable DeFi protocols have open-source code, allowing anyone to audit the code and understand exactly how funds are being utilised. This transparency is a significant improvement over traditional finance, where users often have only a vague understanding of what happens to their capital once it's deposited.

In DeFi, transactions are recorded on a public blockchain, ensuring that all actions are traceable and verifiable. This approach builds trust among users and empowers them to make informed decisions.

DeFi protocols are lean, efficient systems that use smart contracts to automate many cumbersome tasks that burden traditional financial institutions. For example, DeFi borrowers can take out loans in seconds, avoiding the lengthy approval process of conventional banks.

The automation of these tasks leads to faster execution and significant cost savings. Lower operational costs enable DeFi protocols to charge smaller take rates, allowing more value to accrue to end users. By reducing fees and friction, DeFi can make financial products more accessible and affordable.

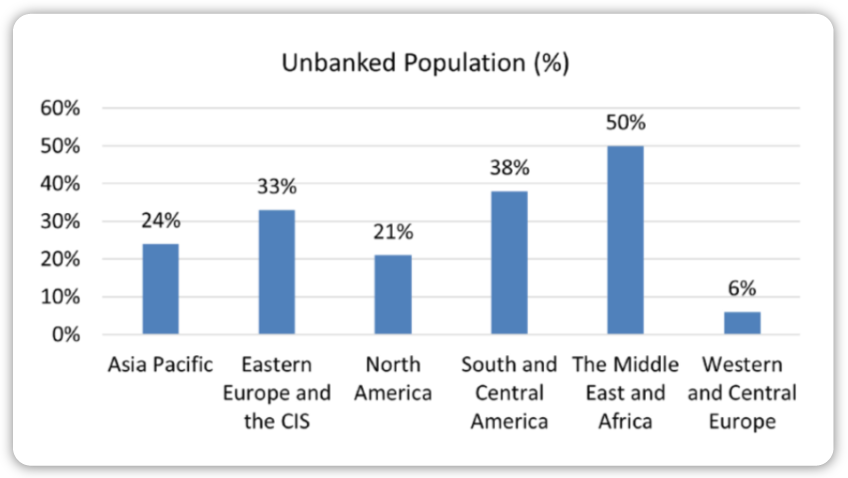

The digital nature of DeFi allows anyone with an internet connection to access financial services, regardless of their location or socioeconomic status. This inclusivity extends the reach of financial products to people traditionally excluded by geographic or income barriers. The unbanked of the world who don't have the ability to access financial services through DeFi can be on a level playing field with everyone in the world.

Moreover, the cost savings from smart contract automation make it possible to profitably service lower-income users. This increased accessibility is a core benefit of DeFi, promoting financial inclusion on a global scale.

DeFi has matured beyond its initial speculation-driven phase at the start of this decade, with robust infrastructure available to support decentralised trading, lending, and more. Below are two potential sources of future growth for DeFi.

Several projects are building secondary layers on the Bitcoin network (e.g. Stacks (STX)). As these projects mature and become more trustless, Bitcoin (BTC) may become increasingly used as collateral in DeFi applications built on these secondary layers.

Ethereum's scalability challenges are being addressed partially through L2 solutions. Should Ethereum L2s (e.g. Arbitrum (ARB), Optimism (OP)) continue to become more performant and scalable, DeFi will likely become far more accessible to many more people.

While DeFi represents an exciting frontier in finance, it comes with its risks:

DeFi protocols rely on smart contracts, which, if not properly secured, can be exploited by malicious actors. The sector will continue to face challenges in maintaining the security and integrity of its platforms.

As DeFi grows, it will increasingly attract regulatory scrutiny. The lack of a central governing body makes it challenging to enforce regulations, creating an ongoing tension between the decentralised ethos and regulatory compliance.

DeFi is one of the core use cases of blockchain technology, offering a range of financial services in a decentralised manner. By addressing key issues of transparency, cost-efficiency, and accessibility, DeFi has the potential to create a more inclusive financial ecosystem that serves users beyond traditional banking reach.

With continued innovation and the potential to integrate new assets and blockchain solutions, the DeFi space is set for further growth. As the sector evolves, navigating its technological challenges, market conditions, and regulatory landscape will be key to its sustained success.