What is Economics?

6 minutes

6 minutes

6 minutes

6 minutes

Economics plays an essential role in shaping the overall well-being of individuals, businesses, and governments. It determines how resources are allocated, influencing job opportunities, wages, and the cost of living. The economy directly affects key aspects of daily life, from housing affordability to healthcare services and even the price of groceries.

When the economy performs well, people generally experience higher employment rates, wage growth, and increased public services. However, economic downturns, such as recessions, can lead to job losses, reduced household spending, and financial stress for many.

Governments closely monitor the economy to make informed decisions about policies that impact public spending, foreign trade and taxes. For example, when an economy is struggling, the government may introduce fiscal policies to stimulate growth and support individuals and businesses affected by unemployment and reduced economic activity. These interventions help stabilise the economy and reduce the impact of recessions.

In a global context, countries' economies are interconnected through international trade and financial markets. Major economies like China and the U.S. play a critical role in shaping the global market. Fluctuations in demand for key commodities (e.g. oil, iron ore) and agricultural products can create ripple effects worldwide.

Changes in trade policies, production output, or economic growth in these large economies significantly impact industries (e.g. manufacturing, mining, energy) in other nations, influencing global employment, investment, and trade balances.

”The ultimate purpose of economics, of course, is to understand and promote the enhancement of well-being.”

– Ben Bernake, Former Chair of the U.S. Federal Reserve

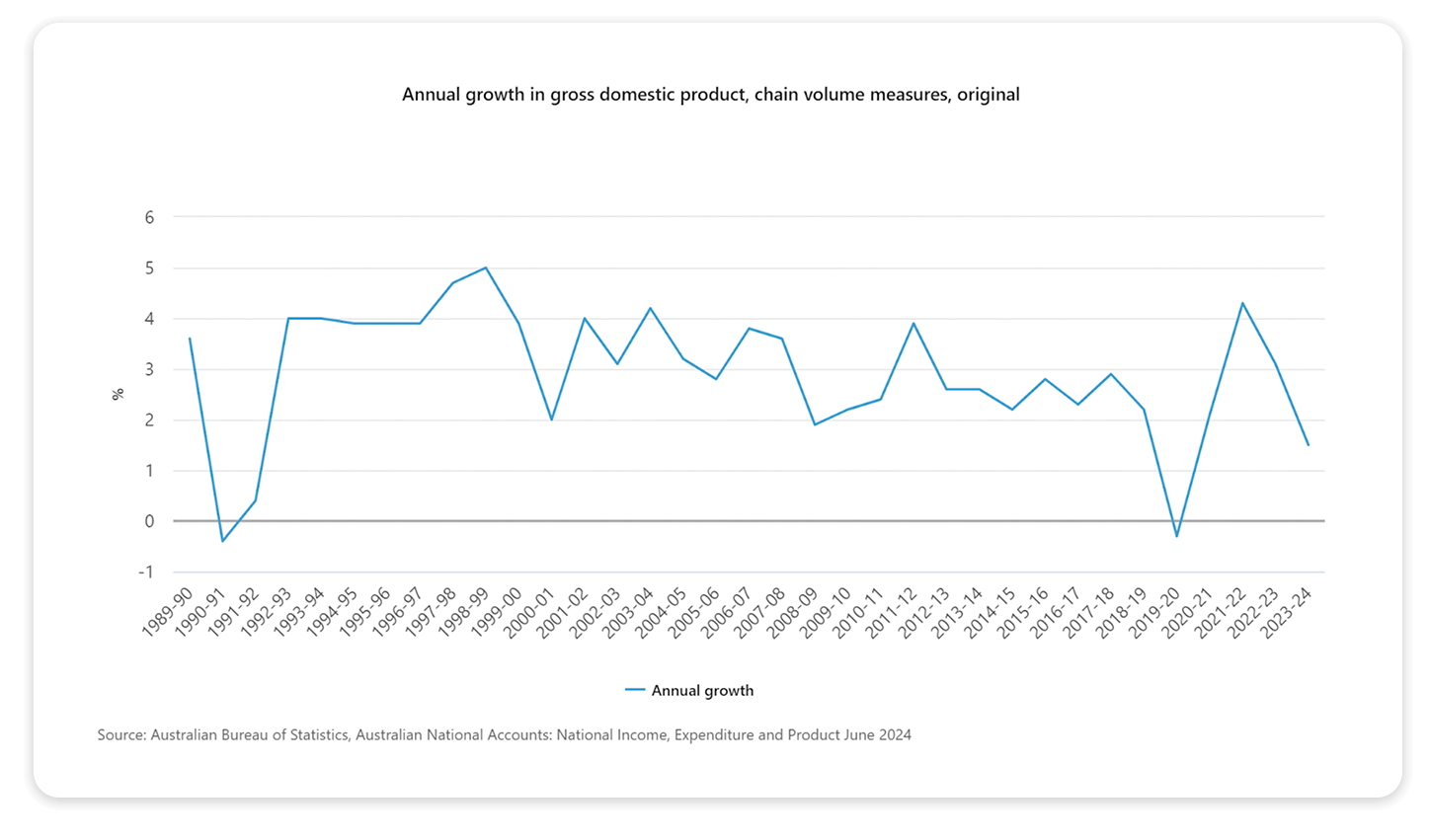

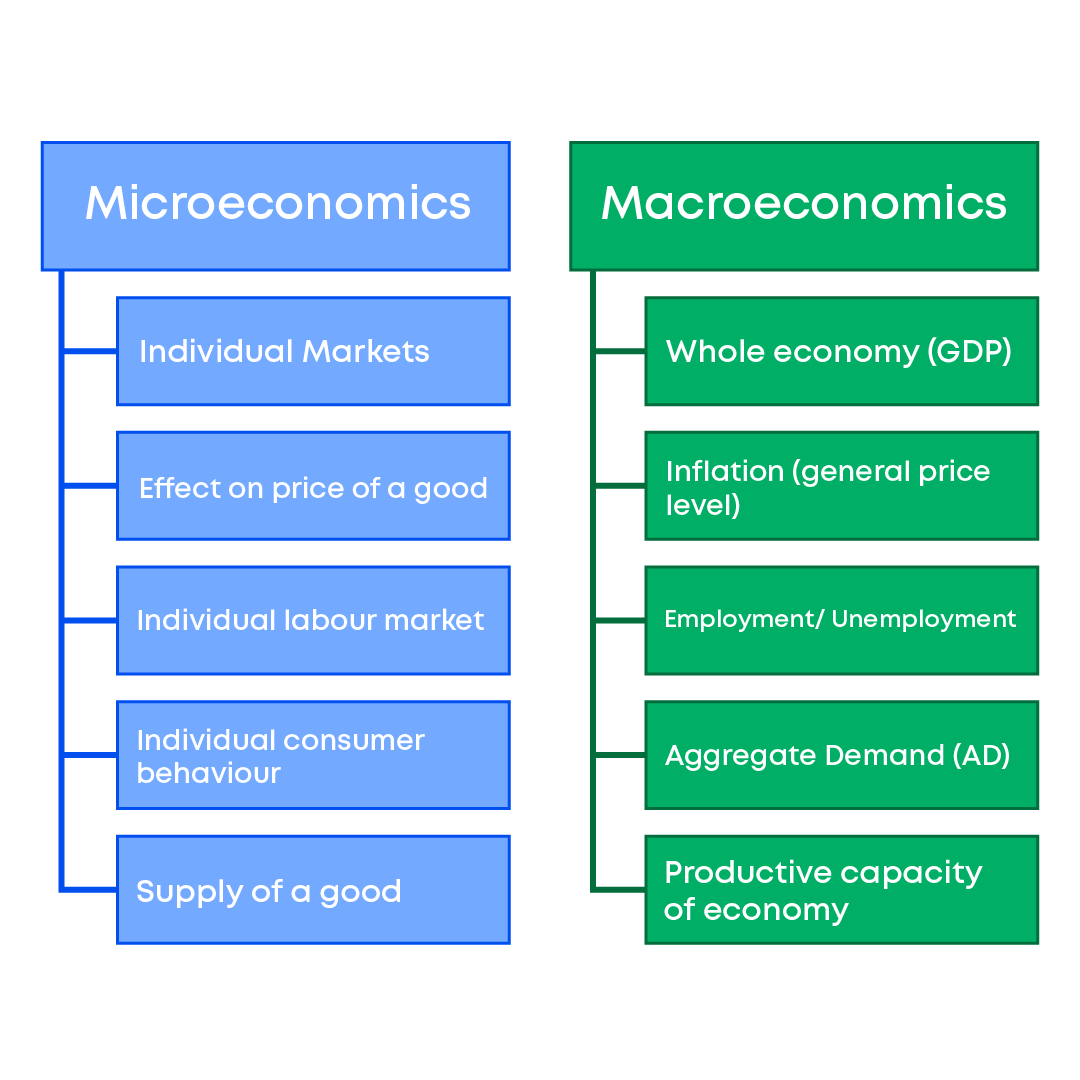

Macroeconomics examines the economy on a large scale, focusing on national and international economic trends and policies. It deals with key indicators such as gross domestic product (GDP), inflation, unemployment, and national income.

For example, Australia’s GDP is a critical measure of the country’s economic performance, representing the total value of goods and services produced over a specific period. When GDP grows, it generally indicates a healthy, expanding economy.

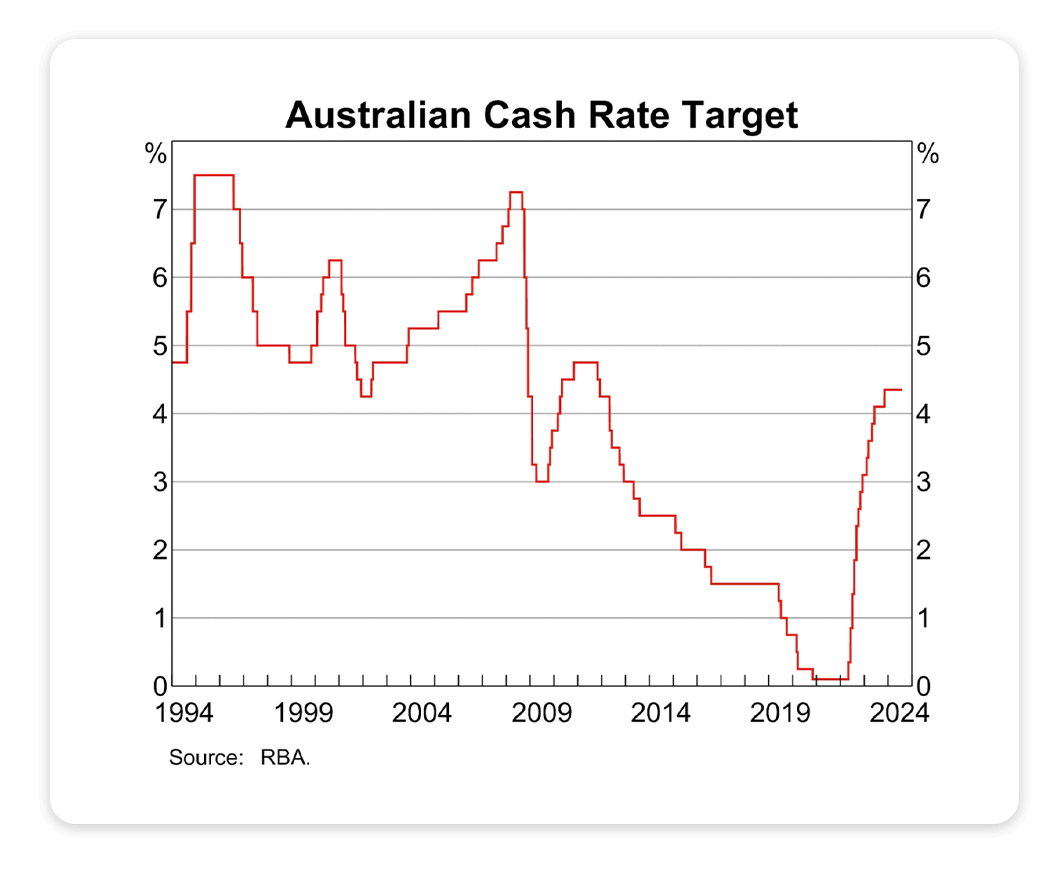

Macroeconomics also includes government fiscal policies, such as how much the Australian government decides to spend on infrastructure or healthcare, and monetary policies like the Reserve Bank of Australia (RBA) adjusting interest rates.

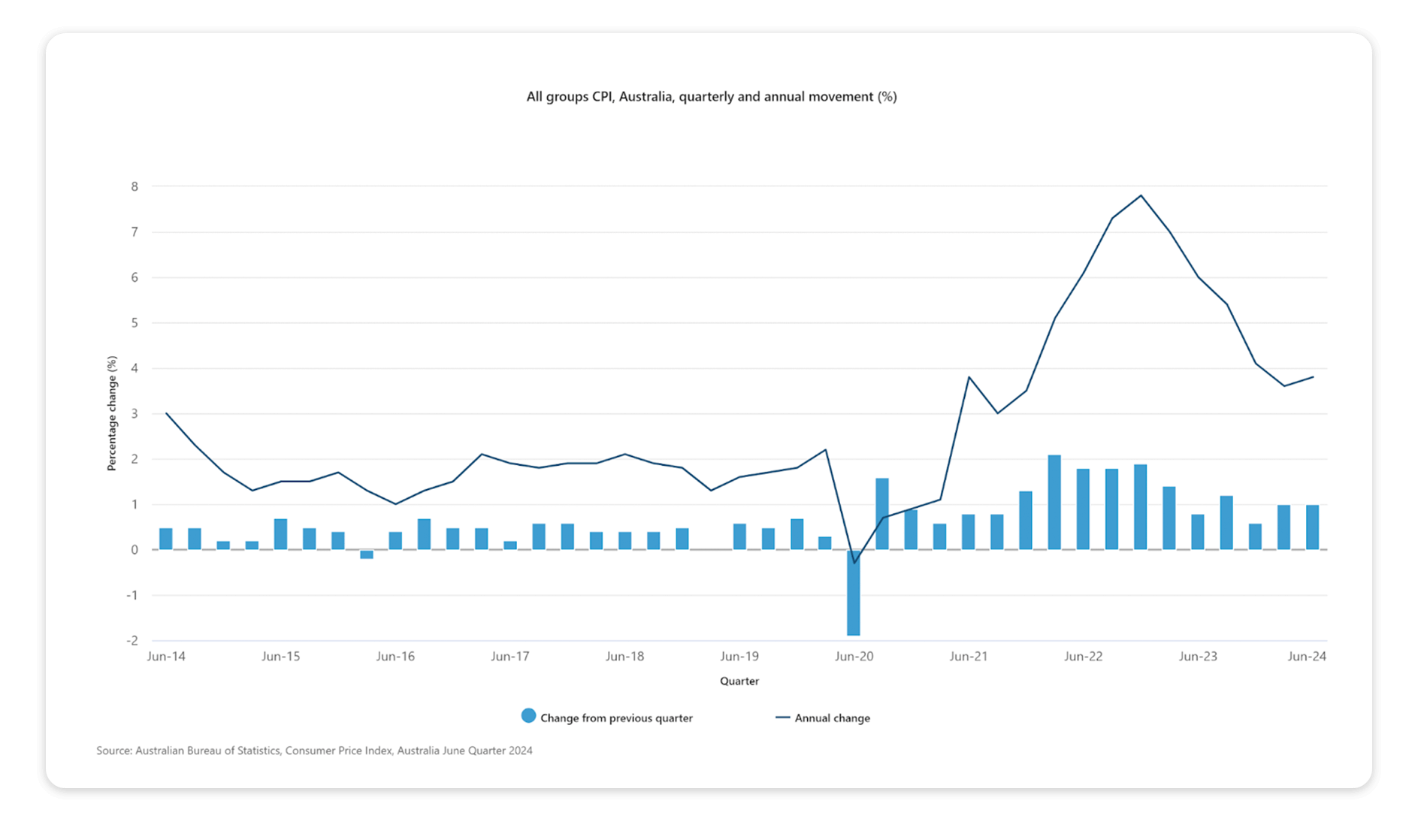

These decisions have far-reaching effects on inflation, employment, and the overall cost of living. For instance, when inflation rises faster than wage growth, Australians feel the pinch as their purchasing power diminishes. Rate decisions by the RBA directly impact mortgage repayments and savings rates.

Microeconomics focuses on individual actors within the economy, such as households, businesses, and industries. It examines how these groups make decisions based on limited resources. For instance, if unemployment rates rise, Australian households might cut back on discretionary spending, like dining out or purchasing luxury goods. Microeconomic factors also include how businesses set prices for their products based on supply and demand, as seen in the housing market where limited supply and high demand in cities like Sydney and Melbourne have driven up property prices.

In Australia, microeconomics helps to explain consumer behaviour and the functioning of specific industries. For example, during periods of economic uncertainty, Australian consumers tend to save more and spend less, affecting businesses in retail and hospitality. Similarly, industries like mining, agriculture, and tourism can be analysed to understand how changes in global demand, environmental conditions, or government policy affect their performance.

When the economy is growing, businesses tend to expand, creating more job opportunities and driving up wages. Conversely, during economic downturns or recessions, companies may cut back on hiring or reduce wages to maintain profitability. This was particularly evident during past economic recessions when unemployment rates spiked as businesses scaled back or closed.

Wage growth is another critical factor. When wage growth is stagnant, many workers find it difficult to keep up with rising living costs. If wages fail to grow at the same pace as inflation, individuals' ability to afford essentials like housing, healthcare, and education is reduced.

Inflation and the cost of living are significant economic factors that affect individuals daily. Inflation represents the rate at which the prices of goods and services rise over time. In periods of high inflation, everyday items like groceries, fuel, and utilities become more expensive, reducing household purchasing power. The most well-known measure of inflation is the Consumer Price Index (CPI).

Interest rates set by a country’s central bank affect the cost of borrowing and influence consumer spending and investment. When interest rates are low, borrowing generally becomes cheaper, encouraging individuals and businesses to take out loans for homes, cars, and other big-ticket items.

This can stimulate economic growth as more money flows through the economy. However, when interest rates rise, borrowing becomes more expensive, which can reduce consumer spending and slow the economy.

For example, a rise in interest rates can lead to higher mortgage repayments, making it more difficult for homeowners to manage their finances. This can result in reduced discretionary spending on non-essential items, affecting businesses in sectors like retail and hospitality. Conversely, low interest rates can encourage more spending and investment, boosting economic activity.

The economy is a complex system that affects every aspect of life, from employment and wages to the cost of living and government services. By understanding the difference between macroeconomics and microeconomics, individuals can better navigate the economic factors that impact their everyday lives. Whether through government policies, interest rates, or the stock market, the economy plays a vital role in shaping the financial well-being of individuals and communities globally.